Overview of Exness Account Types

Exness offers you various types of accounts that are perfect in their particular perspective. While some of these accounts are geared towards low trading costs, others provide advanced features for more established traders.

Standard Account

The Standard account is the most popular.Easy and flexible, useful for all traders. Zero commission trades, starting from 0.3 pips spread It is just $10 deposit to get started. This account is perfect for beginners and experienced traders looking to keep it simple when trading.

Standard Cent Account

For those new to trading, the Standard Cent account is best. You can learn to trade on an account that lets you place trades with cents instead of dollars, so this way as well your broker if fixing his own the practical will also not be perfect. Spreads have a 0.3 pip start and are commission-free (like the Standard account). The ideal solution for those who want to trade with real money but have fear of losing a lot.

Raw Spread Account

For those traders who require tight spreads the Raw Spread Account was created. It can provide spreads as low as 0.0 pips but with a slight commission per trade. Perfect, if you’re scalper or even a day trader who needs accuracy and fast execution. Although you pay a commission, the extremely low spreads can save you money on larger trades.

Zero Account

The Zero account is perfect for traders who need fixed costs.Zero pip spreads on the major pairs, but with a fixed commission per trade This is a great account for those high-volume traders who would like complete transparency about how much trading will cost. It is very predictable and easy to manage, especially for traders with hundreds of trades a day.

Pro Account

The Pro account is for experienced traders. It offers instant trade execution and tight spreads starting from 0.1 pips, with no commissions. This account is great for traders who need fast and precise execution, especially when making quick decisions in the market. It’s tailored for those who know what they’re doing and need professional-level conditions.

Detailed Comparison of Exness Accounts

Exness offers multiple types of accounts to suit the trading requirement. This section of the guide looks at some of the primary differences, concerning important factors such as deposit requirements, spreads & commissions available instruments leverage and platforms. Knowing this information will assist you to decide what is the best for your needs.

| Account Type | Minimum Deposit | Spreads | Commissions | Execution Type |

| Standard Account | $10 | From 0.3 pips | No commission | Market execution |

| Standard Cent | $1 | From 0.3 pips | No commission | Market execution |

| Raw Spread | $200 | From 0.0 pips | From $3.50 per lot | Market execution |

| Zero Account | $200 | From 0.0 pips | Fixed per trade | Market execution |

| Pro Account | $200 | From 0.1 pips | No commission | Instant execution |

Minimum Deposit Requirements

The deposit percentage depends on the type of an account. You could begin trading with just $1 or 10$, perfect for beginners, or those looking to dip their toe in the water, available on Standard Account and Standart Cent Account.

Alternatively, the Raw Spread, Zero or Pro Accounts all require a minimum deposit of $200. These are best for traders who can trade with more because these accounts bring advanced trading conditions. If you’re looking for lower costs to get started, the standard accounts might be best, but if you want premium features, the higher deposit accounts are worth considering.

Spreads and Commissions

When it comes to trading costs, spreads and commissions play a big role. The Standard and Standard Cent Accounts offer spreads starting from 0.3 pips and do not charge any commission, which is great for traders who want to avoid extra fees.

For more experienced traders who prefer tighter spreads, the Raw Spread Account and Zero Account offer spreads starting from 0.0 pips. However, these accounts come with a small commission—Raw Spread charges $3.50 per lot, while Zero has a fixed fee per trade. The Pro Account gives you spreads starting from 0.1 pips and no commission, which provides a good balance of low costs and professional trading conditions.

Available Instruments

Whatever type of Exness account you use, you can trade a variety of instruments. FX-based (forex pairs), cryptocurrency, stocks: only selected assets are available for the social trading function. This means you can trade major currency pairs such as EUR/USD, so of the popular shares or choose different markets like gold and Bitcoin for that added flexibility in your trading.

Leverage Options

Leverage allows you to trade larger positions with a smaller amount of capital. Exness offers high leverage options across all accounts. For Standard and Standard Cent Accounts, leverage can go up to 1, making them ideal for traders who want to maximize their trading power with minimal capital.

For the Raw Spread, Zero, and Pro Accounts, leverage is also high, although the exact limits can depend on where you’re trading from and the instruments you choose. High leverage can significantly increase potential profits, but it also carries greater risk, so it’s important to use it carefully.

Trading Platforms

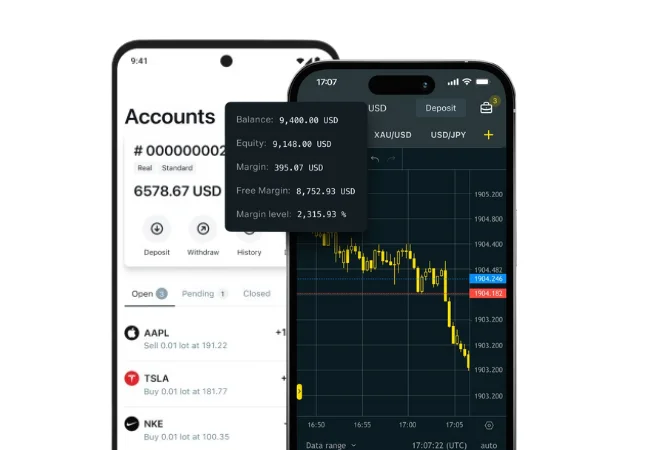

Exness has various trading platforms which are convenient for different preferences. All accounts can be used with MetaTrader 4 (MT4) and the new globally popular trading platform MetaTrader 5 (MT5). These features generally include advanced charting tools and automated trading systems through expert advisors (EAs).

Exness Trader App is available for mobile trading with both account types. It also gives you the option of tracking your trades and managing your account from anywhere with just a tap on your smartphone. Exness offers desktop, web and mobile trading options that allow you to trade the way it suits you.

How to Open an Exness Account

Opening an Exness account is easy and fast. Follow these simple steps to get started:

- Go to the Exness Website: Visit the Exness website and click on “Open Account.”

- Enter Your Information: Provide your email, set a password, and choose your account currency.

- Verify Your Identity: Upload documents like an ID and proof of address to confirm your identity.

- Pick Your Account Type: Choose from Standard, Standard Cent, Raw Spread, Zero, or Pro based on your trading needs.

- Make a Deposit: Add funds to your account using your preferred method, like a bank transfer, credit card, or e-wallet.

- Start Trading: Once your deposit is done, you can start trading right away using the MetaTrader platform or the Exness Trader app.

Exness Demo Account

A demo account lets you practice trading without risking real money. It’s perfect for beginners or anyone who wants to try out new strategies.

Steps to Open a Demo Account:

- Visit the Exness Website: Click on “Open Demo Account.”

- Register Your Details: Fill in your information and select the demo option.

- Choose a Trading Platform: Pick MetaTrader 4 or 5 to start trading.

- Start Practicing: Use virtual funds to trade in real market conditions, so you can learn and improve your skills without any risk.

The demo account is a great way to build confidence before you start trading with real money. You can switch to a live account whenever you’re ready.

Exness Swap-free Account

If you might prefer not to pay or receive interest fees (for example because you follow Islamic principles) the Exness Swap-free Account could be best. Traders with a regular account pay or are paid swap when trades are left open overnight. Yet, a swap-free account is the right choice for those traders that are in this business with big long term plans because there is no overnight commission due to that.

This trading account comes in the Form of Swap Free Account, Simply Signup for a Trading Account with Exness to Get it. It is applied automatically in your area if you have this option. This does not require manual activation. After activating your account, you are free to trade without fear of being charged any interest on it. Everything else remains the same, you continue to have access to the same spreads, commissions and tools.

Choosing the Right Exness Account

Picking the right Exness account depends on your trading style, experience, and how much you plan to invest. Here’s a simple guide to help you choose:

- Standard Account: Perfect for beginners. It has no commission and low spreads starting from 0.3 pips. You can start with just a small deposit, making it great for those new to trading.

- Standard Cent Account: Best for beginners who want to trade small amounts. You trade in cents, which helps reduce risk while you learn and gain experience.

- Raw Spread Account: If you’re looking for very tight spreads starting at 0.0 pips, this account is a good choice. There’s a small commission per trade, making it ideal for experienced traders who need precise pricing.

- Zero Account: This account offers spreads from 0.0 pips and is great for traders who like to trade large volumes. There’s a fixed commission, so you always know your trading costs upfront.

- Pro Account: Best for experienced traders who want quick execution with no commissions. It offers tight spreads starting from 0.1 pips, giving you the benefits of professional trading conditions.

To choose the best account, think about how you like to trade. If you’re new, a Standard or Standard Cent account may be the easiest place to start. If you’re more experienced, consider the Raw Spread, Zero, or Pro accounts for better trading conditions and tighter spreads.

Pros and Cons of Exness Accounts

Exness offers different types of trading accounts, each with its own advantages and disadvantages. Here’s a simple breakdown to help you understand the pros and cons.

Pros of Exness Accounts

- Low Starting Deposits: The Standard and Standard Cent Accounts require very little money to start, making them great for beginners.

- No Commissions on Some Accounts: Accounts like the Standard and Pro don’t charge any commission, which can help keep your costs low.

- Tight Spreads: The Raw Spread and Zero Accounts offer very low spreads, starting at 0.0 pips, which can save you money on trades.

- High Leverage: Exness provides high leverage options, up to 1, allowing you to trade bigger amounts with a smaller deposit.

- Many Trading Options: All accounts let you trade different instruments like Forex, cryptocurrencies, stocks, metals, and more.

- Multiple Platforms: You can use MetaTrader 4, MetaTrader 5, or the Exness Trader App, giving you flexibility to trade how you prefer.

Cons of Exness Accounts

- Higher Deposits for Some Accounts: The Raw Spread, Zero, and Pro Accounts require a $200 minimum deposit, which may be too high for some beginners.

- Commissions on Some Accounts: While Raw Spread and Zero Accounts have low spreads, they charge a small commission per trade, which could add up if you trade a lot.

- Risk with High Leverage: High leverage can lead to bigger profits, but it also increases the risk of bigger losses, especially for new traders.

- Complex for Beginners: Some accounts, like Raw Spread and Zero, might be harder for beginners to manage because they combine low spreads with commission fees.

Frequently Asked Questions

Which Exness account type is best for beginners?

The standard account is the best choice for beginners. It’s easy to use, has a low deposit requirement, and no commission fees. If you prefer to trade with smaller amounts, the standard cent account lets you trade in cents, making it great for learning.