- Comprehensive Exness Funding Options

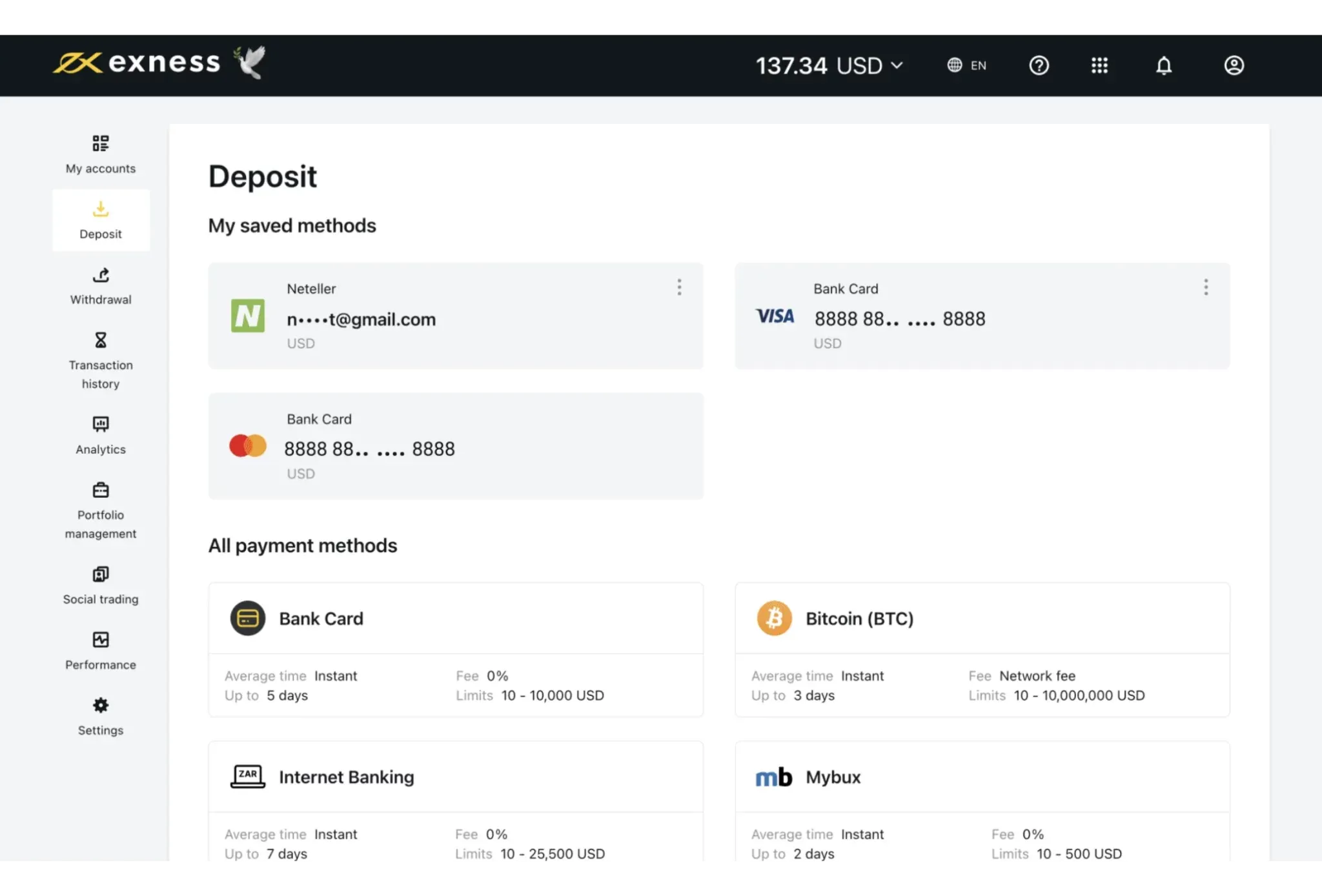

- Deposit Methods in Exness

- Minimum Deposit Requirements

- How to Fund Your Exness Account

- Processing Times and Fees for Deposits

- Exness Withdrawal Methods

- Minimum Withdrawal Requirements

- How to Withdraw Funds from Your Exness Account

- Time and Charges for Processing a Withdrawal

- Bangladeshi Traders’ Local Payment Options Exness

- Security Measures and Verification Exness

- Troubleshooting Common Issues

- How to Choose the Best Exness Payment Method For Your Needs

- Conclusion

- FAQs

Comprehensive Exness Funding Options

Exness teamed up with trusted payment companies; hence this process for making deposits or withdrawals is completely secure. Easy and reliable ways to manage trading funds are the musts, and therefore, Exness offers traders a wide choice of safe and convenient methods for deposits and withdrawals.

| Payment Method | Minimum Deposit | Maximum Deposit | Deposit Fee |

| Credit/Debit Card | $10 | $40,000 | Free |

| Bank Wire Transfer | $100 | No limit | $10-$35 |

| Skrill | $5 | $40,000 | Free |

| Neteller | $20 | $30,000 | 2.5% |

| UnionPay | $100 | $100,000 | Free |

Deposit Methods in Exness

Exness has several ways to deposit money into your trading account. You can select the most convenient ones for you.

Available Deposit Methods

The following methods are accepted for deposit in Exness trading accounts:

- Credit/Debet Cards: Visa, Mastercard, Maestro

- Bank Wire

- E-Wallets: Skrill, Neteller, UnionPay

Some traders use e-wallets because of the faster processing time. Others prefer bank wires when they need to process a larger amount. You can also use credit or debit cards for the sake of convenience.

Minimum Deposit Requirements

Exness knows that you may not have much money when you start—very noble of them. So they do accept small minimum deposits.

- E-Wallets: Skrill, WebMoney, with $5 as the minimum deposit

- Bank Wires: The minimum deposit is $100. This amount is all covering of the bank’s fees

- Credit/Debit Cards: The minimum deposit is $10, accessible by a significant number of traders.

You pick the means — Exness aims to let you focus on trading and not worry about the payment.

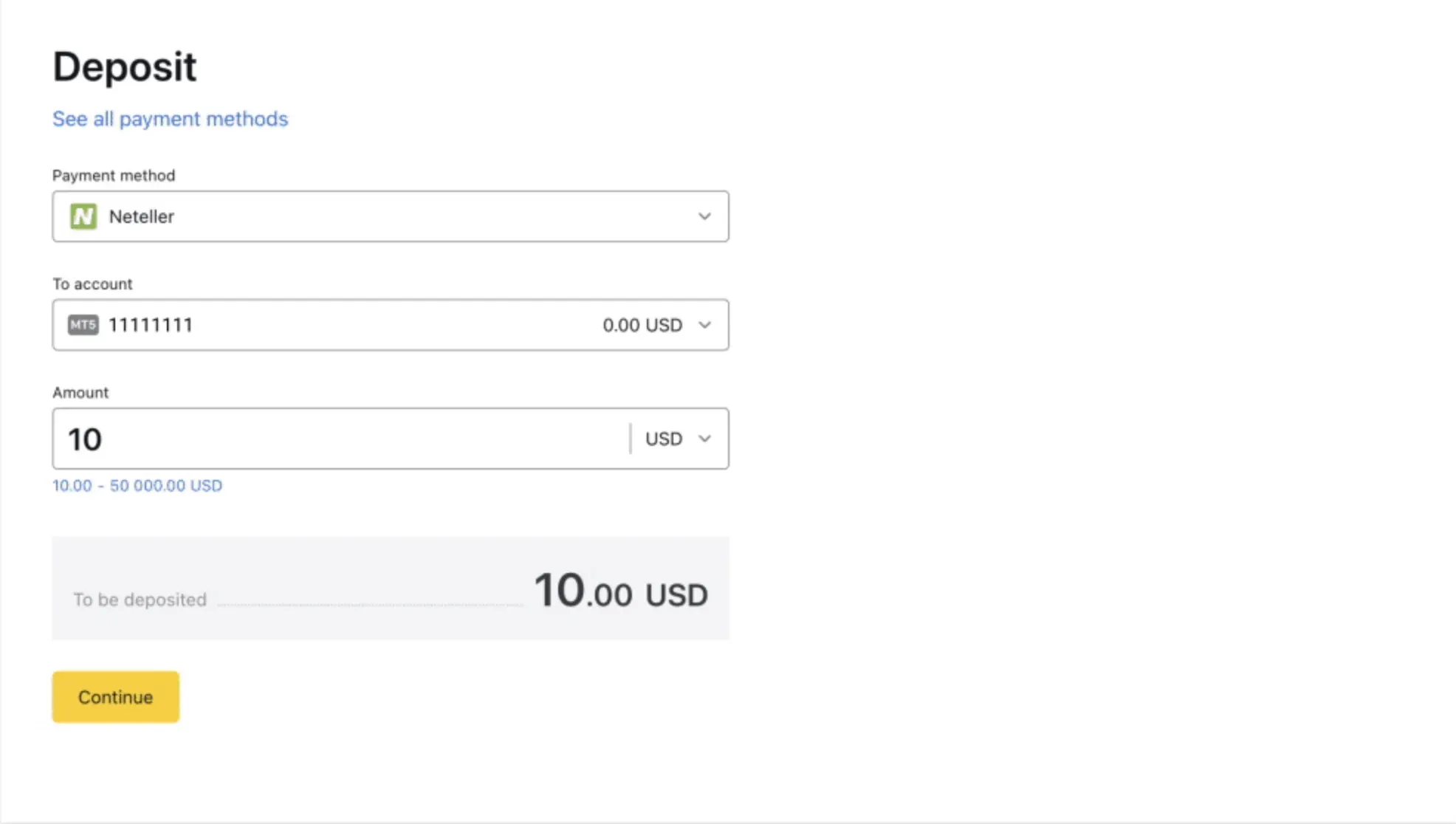

How to Fund Your Exness Account

Funding of your trading account can be made with Exness through the following steps:

- Log in to your Exness account.

- Go to “Deposit.”

- Choose the method of deposit:

- Credit/Debit Card

- E-Wallet (Skrill, Neteller)

- Bank Wire Transfer

- In case of a card, fill in the required details of your card and the amount you want to deposit.

- You will be redirected to the website of the e-wallet to complete a deposit in case you select an e-wallet.

- In the bank wire method, specify your account number and bank details.

Your money will be in your trading account within just a few easy clicks.

Processing Times and Fees for Deposits

Processing Times:

- E-Wallets and Cards: Instant mostly or very fast

- Bank Wires: Several days

As for fees:

- Most Deposit Methods: Free at Exness

- Bank Wires: Probably $10-$35

- Some E-Wallets, such as Neteller: Small percent fee

Remember to always check the specific fees and processing times for your chosen deposit method so that you know when funds will be ready to trade.

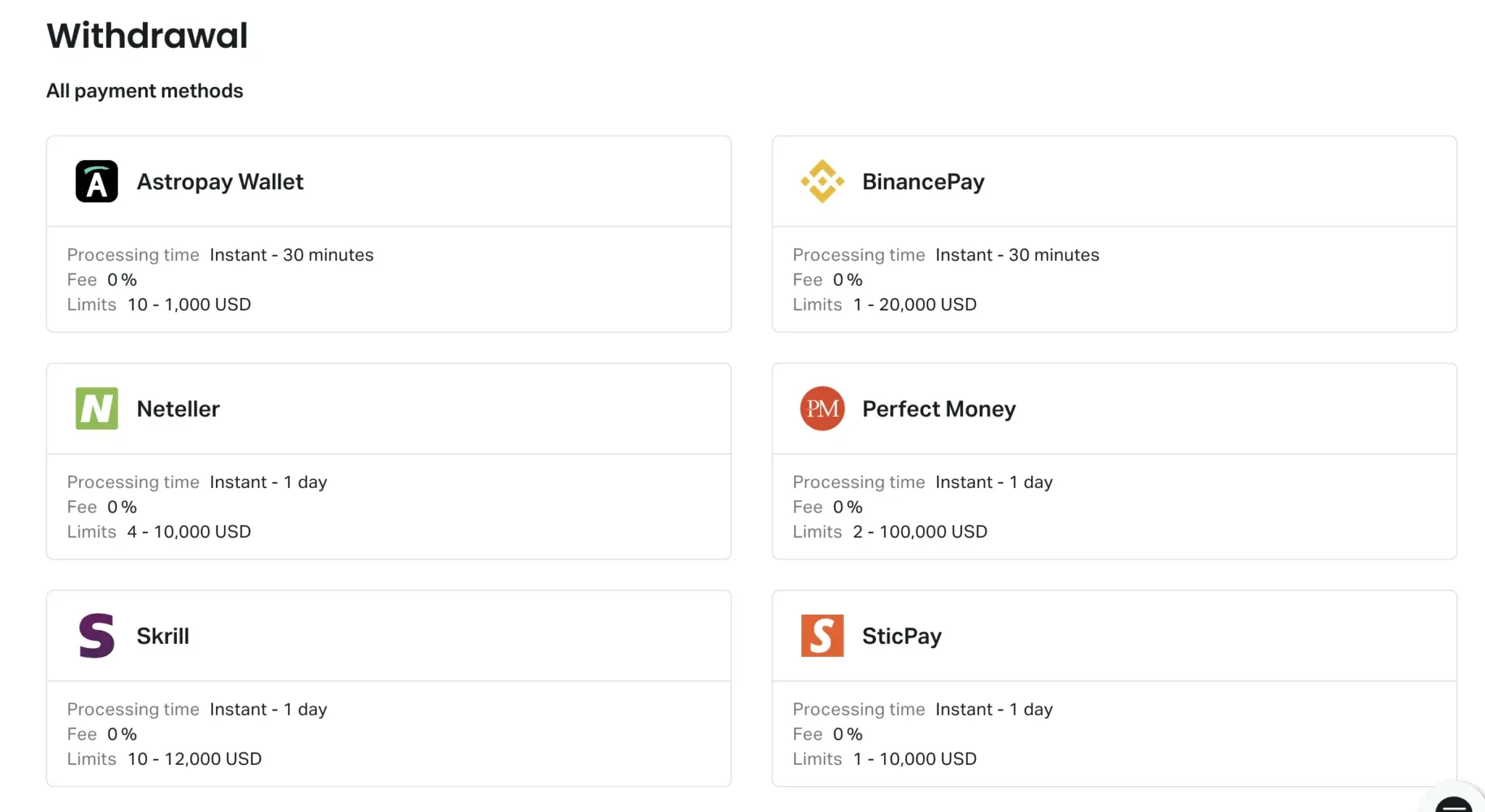

Exness Withdrawal Methods

When you want to cash out of your trading profits, Exness provides several options to do so.

Supported Withdrawal Methods

Log in to your Exness account and withdraw funds using:

- Credit/debit cards

- Bank wire transfers

- Popular e-wallets like Skrill, Neteller, WebMoney, and UnionPay

E-wallets are fast and convenient. Bank wires are good for larger amounts. Cards are easy if you used one to deposit.

Minimum Withdrawal Requirements

The minimum amount you can withdraw varies by method:

- E-wallets like Skrill: $5 minimum

- Bank wire: $30 minimum

- Credit/debit cards: $10 minimum

These minimums help cover transaction fees. Larger Withdrawals are often less expensive as a percent of the amount.

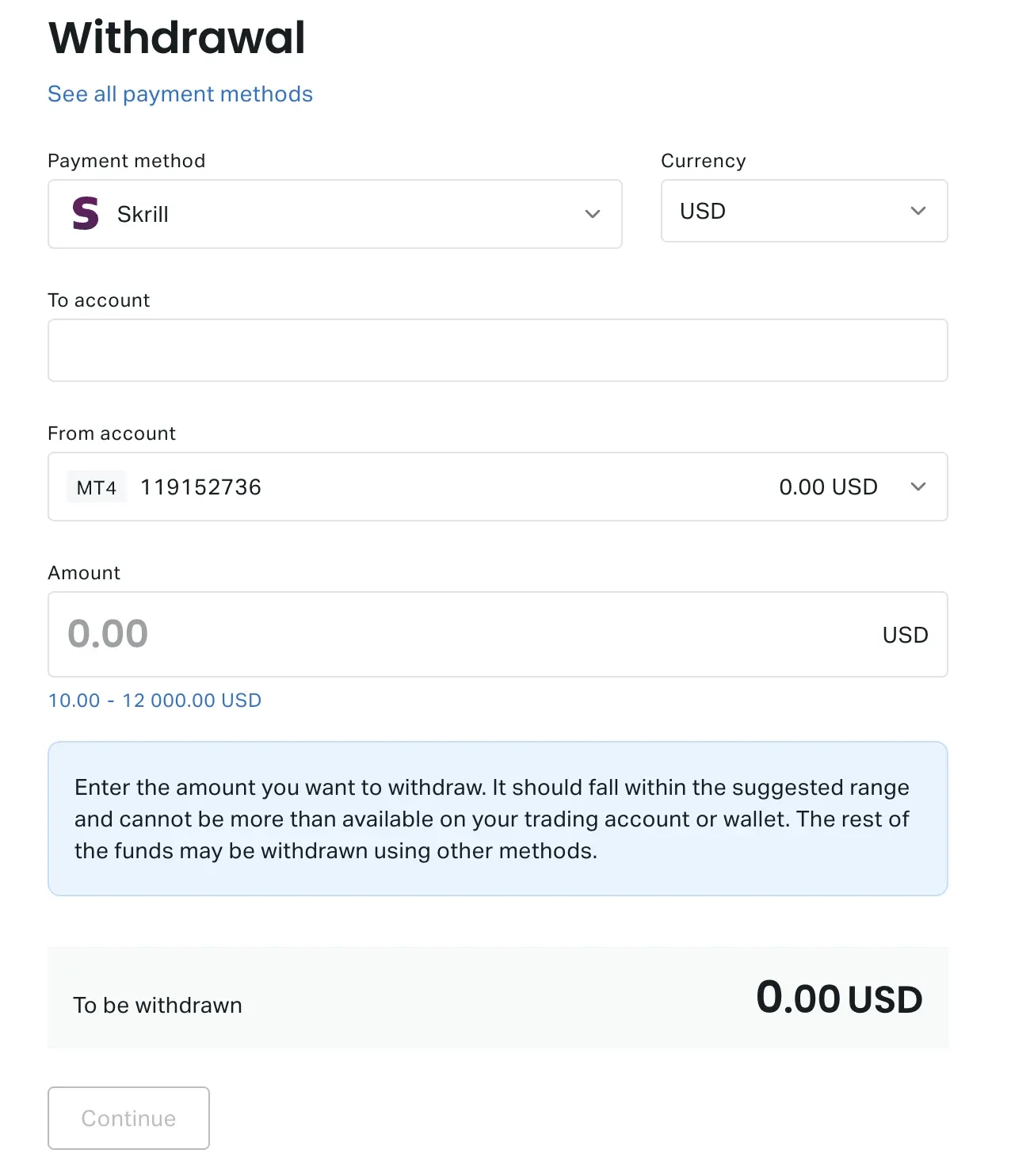

How to Withdraw Funds from Your Exness Account

To withdraw funds:

- Log into your Exness account.

- Proceed to the “Withdrawal” section.

- Choose the method by which you wish to withdraw funds.

- Enter details in accordance with the preference opted for in step 3. It may be a card number or bank details.

- Mention the amount you wish to withdraw.

- Verify the withdrawal request.

After requesting, every withdrawal is security-checked by Exness and then sent for processing.

Time and Charges for Processing a Withdrawal

- E-wallet withdrawal: Within 1-2 working days

- Card withdrawal: 3-5 working days.

- Bank wires: The processing time may differ and is approximately 5-7 working days. Most methods do not include a charge at Exness’s end, though most banks will independently deduct a fee for the wire, usually around $10-$35.

Moreover, e-wallet Withdrawals will further include a percentage fee, as 2% if you have used Neteller.

Consider the processing time and fees when deciding on the best way to get your money back. You will be better placed to choose the best alternative for your case with the various options Exness has provided.

Bangladeshi Traders’ Local Payment Options Exness

Exness offers localized payment options for traders in Bangladesh. You can top up with the bKash mobile money service or even make a direct deposit from your BRAC Bank or Dutch-Bangla Bank account.

It’s easier and more-cost-effective to use local means in place of international ones. Please be aware of the differences in the limits on the amount to be transferred and the processing time, though.

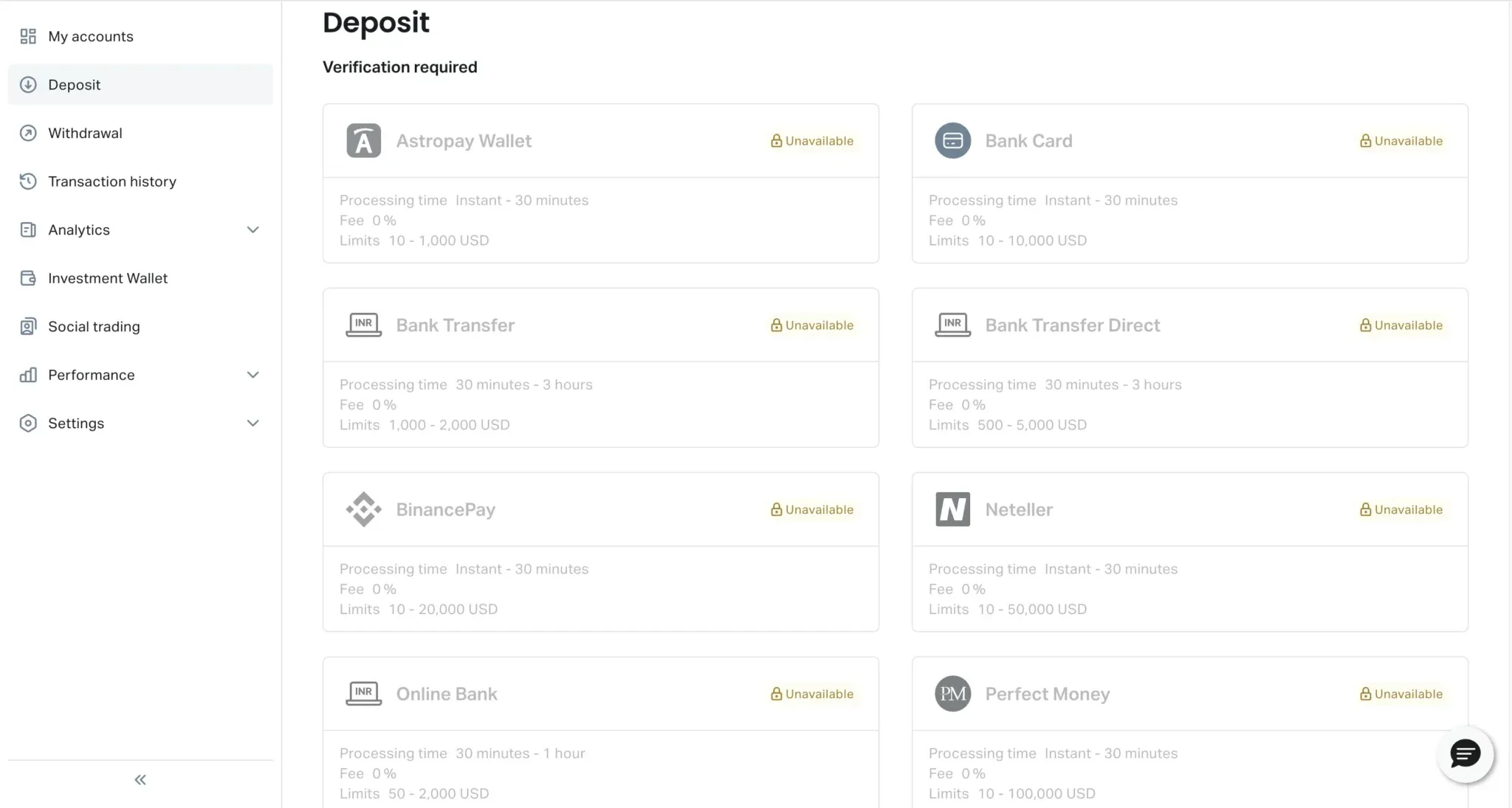

Security Measures and Verification Exness

Consumers’ money and information are very paramount according to Exness priorities. Key among the measures taken are:

- Encryption of data between clients and the company

- Separate Funds: Customers’ money must be separated from the company’s funds.

- Identify Verification: Everyone’s identity needs to be verified before opening new accounts.

Thus, for the protection from fraud and other wrong deeds, traders may be asked to provide a copy of their governmental ID, proof of address, or even the source of funds.

Troubleshooting Common Issues

Sometimes, deposits or withdrawal may get stuck. It doesn’t matter; Exness support has your back. The most common issues include:

- Declined Transaction: Insufficient balance or card limit.

- Wrong Payment Details: Mistakes made during entering the details of the payment.

- Technical Errors: The problem in processing of the payment.

They will help you through the process of fixing it or investigate the matter if need be. Do not hesitate to contact them – they are here to solve any hitches quickly.

How to Choose the Best Exness Payment Method For Your Needs

Among the various available options, it could be challenging to make the right choice. Some of the key factors that need to be considered are:

- Convenience of use

- Fees involved

- Transaction processing times

- Transfer limits

- Suitability of local options

For example, while e-wallets are excellent in terms of speedy and cheap deposits, they do charge fees for withdrawals. Bank wires are best suited for larger transactions, but they are much slower. This greatly depends on your style of trading and personal preference.

Conclusion

Exness has many ways for easy depositing or withdrawing funds. They even include some local options for Bangladeshi traders. Safety is guaranteed by verification of the accounts and protection of your data. The support team will help in case any issues happen.

Reviewing all the available payment methods, a trader would be able to pick the ones that will suit him best according to his style and needs. You can focus on trading strategies instead of bothering about money transfers.

FAQs

What payment methods are available on Exness?

Exness offers various payment methods including credit/debit cards, e-wallets like Skrill and Neteller, and bank transfers. Local options like bKash are also available for some regions.